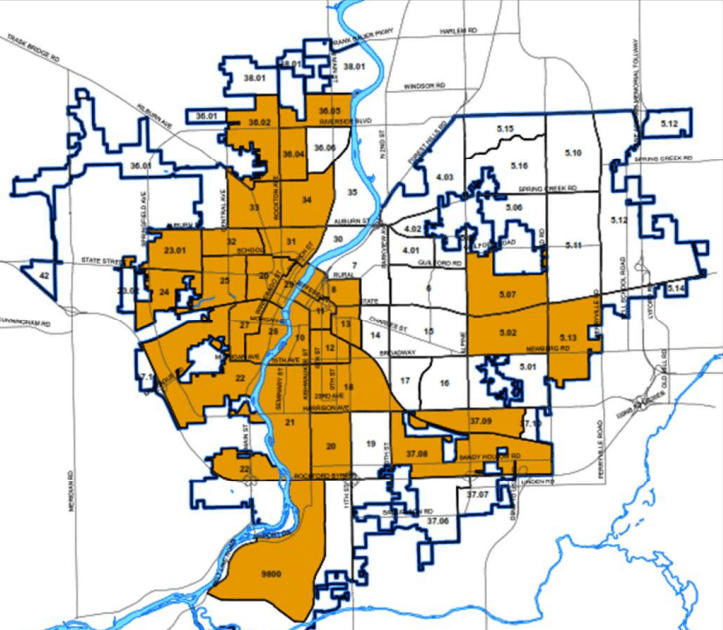

The highlighted census tracks show what areas of the city are eligible for the new business growth grants from the city of Rockford. (Image via city of Rockford)

The highlighted census tracks show what areas of the city are eligible for the new business growth grants from the city of Rockford. (Image via city of Rockford)Rock River Current

Get our mobile app

ROCKFORD — The city of Rockford is offering a new financial assistance program designed to help for-profit businesses add jobs and grow their operations.

The Business Growth program offers up to $25,000 in forgivable loans for businesses to purchase equipment or pay other expansion expenses such as employee salaries, rent and marketing costs. A business must add at least one new job to qualify for any funding, which comes in the form of a 50/50 match up to $25,000. The city expects to award about five total loans.

More business: Local couple prepares to build fourth 24/7 Laundromat on East State Street in Rockford

A total of $125,000 is available, which comes from the U.S. Department of Housing and Urban Development’s Community Development Block Grant program.

“This offering is unique as it delivers funding to local businesses and creates new jobs for our citizens. It’s a win-win,” Mayor Tom McNamara said in a news release. “We take pride in providing business owners with a financial opportunity to grow right here in Rockford.”

The program is intended to encourage job creation for low-to-moderate income individuals, and businesses must operate within certain census tracts to be eligible for the funding. The eligible areas include a large swath of west Rockford, as well as business districts in and around downtown, in south Rockford, and on the east end of the city.

Applications are open now through midnight June 23.

Eligibility

Applicants must be a for-profit business established on or before May 1 and located in one of the identified areas.

Interested businesses can apply online at Rockfordil.gov/BusinessGrowthProgram through June 23.

Those who need technical assistance can contact Francisca French at Francisca.French@RockfordIL.Gov or 779-348-7419. Requests for technical assistance must be made by June 9, 2024.

Eligible projects include:

- Purchase of equipment.

- Operating expenses associated with business expansion (inventory, employee salaries, rent, operating expenses and advertising/marketing expenses).

(Eligible projects should enhance the employment opportunities of low– and moderate income persons. Job creation must be included within the project and will be verified during the performance period through submission of W-2 tax forms.)

Ineligible projects include:

- Construction.

- Purchase of property or a new lease agreement.

- General community promotion projects.

- Assistance for professional sports teams.

- Assistance for privately-owned recreational facilities that serve predominately higher income clientele, where the recreational benefit to users or members clearly outweigh employment or other benefits to low-to-moderate income individuals.

Eligible applicants include:

- For-profit businesses legally established and operating within the city of Rockford’s municipal boundaries.

- Business is located in a property zoned commercial or industrial

- Business was established by May 1, 2024 documented through registration by the state or county.

- Business is registered with the official U.S. Government System for Award Management (SAM.gov), and will have an Active status at the time of assistance.

Ineligible applicants include:

- Home-based businesses.

- Businesses established after May 1, 2024.

- Businesses that primarily engage in speculative activities that develop profits from fluctuations in price rather than through normal course of trade.

- Nonprofits.